You probably have good intentions when you borrow money, but finances don’t always work out as planned. A job change or health event can quickly throw you off track, and eventually you may “default” on your loans. It’s important to know how defaulting affects your financial health.

What Does It Mean To Default on a Loan?

Simply put, a loan enters default when the borrower fails to pay the lender per the terms in the initial loan agreement. The time frame before default kicks in can differ from one loan to another. If you miss one or two payments, you may incur fees, and your loan may be designated as “delinquent,” but typically you can return to good standing by making a full payment within a reasonable amount of time. However, if you cannot pay in full by the terms of your initial contract, then you are officially in default.

General Loan Default Consequences

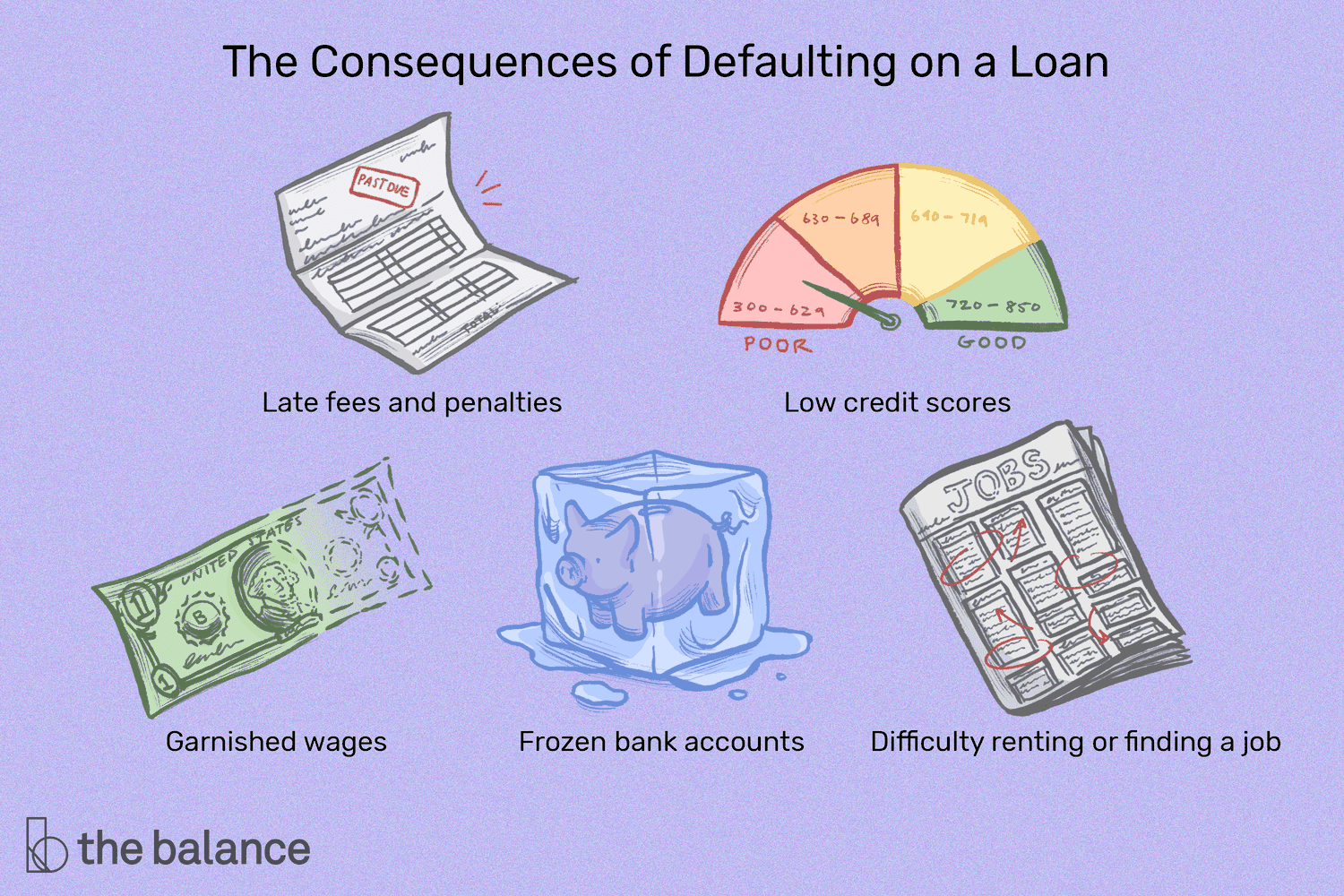

Breaching a loan contract comes with consequences. Defaulting sends a red flag to other financial entities that you are not a reliable borrower, and may not be trustworthy in other aspects as well.

Damage to Your Credit

If you fall into default, your credit will certainly suffer. Your credit score is made up of many factors, but the most significant is your payment history. This includes your standing with all outstanding accounts, loans, credit cards, or other lines of credit.

Some lenders report delinquencies if you’re late on a bill. For the first 30 days after a payment is due, you’re probably in the clear, but missed payments that lead to default will be reported to credit bureaus, resulting in lower credit scores.

Note

Low credit scores can impact several areas of your life. You might have a harder time renting, finding a job, signing up for utilities and mobile phone service, and buying insurance.

Increased Costs

Defaulting can also increase your debt. Late payment fees, penalties, and legal costs might be added to your account, increasing the total balance you owe.

In fact, considering the effects of compound interest, outstanding debt grows quickly. When you miss payments, your monthly interest charges are added to the principal balance of the loan; future interest is then charged on this greater balance, which can quickly snowball.

Legal Issues

When all else fails, lenders send unpaid debts to collection agencies. Collections can damage your credit, incur legal judgments, and can be expensive. In some unfortunate instances, debt collectors can be quite a nuisance, too.

In a case with a court judgment, a lender might be able to garnish your wages or even take assets from your bank accounts.

Consequences Based on Loan Type

Depending on the type of loan, defaulting draws additional specific consequences. Some loans come with a built-in set of remedies for default, and some rely on trust alone.

Secured Loans

If your loan was secured with collateral, such as your home or car, the lender can potentially reclaim that property. Defaulting on a secured loan acts as a trigger for the lender to seize the collateral to make up for your unmet debt.

If you default on a car loan, for example, the vehicle can be repossessed and sold. You might also be liable for a difference in value if the car sells for less than you owe. Repossession also applies to any title loans you’ve taken out on the car for extra cash.

Mortgages are also secured. Defaulting on a home loan is severe, as your lender can force you out through foreclosure and sell your home to collect the loan balance. If the sale doesn’t cover the entire amount you owe, you might still owe the difference or “deficiency,” depending on state laws.

Note

In the wake of COVID-19, federal legislation created various forms of debt relief through the CARES Act. Homeowners were granted forbearance and foreclosure protections through Sept. 30, 2021, with provisions specific to each state.

Unsecured Loans

For unsecured loans (which have no linked collateral), lenders can only damage your credit and try to collect by taking legal action.

Federal student loans, for example, are offered on faith alone. If you default, your lender can seek remedy through other federal departments by withholding tax refunds, garnishing wages, or cutting Social Security payments.

Note

Under the CARES Act, federal student loans went into automatic forbearance, with no interest accrual. Collection activities are paused through Aug. 31, 2022.

Credit cards also fall into the category of unsecured debt. Defaulting on a credit card loan will certainly affect your overall credit. You can also expect hefty fees, high interest rates, and calls from collection agencies in an attempt to collect what you owe.

How To Avoid Defaulting on a Loan

Preventing default is less painful than fixing it after the fact. Here are a few strategies if you’re close:

- Contact your lender: If you’re struggling to make payments, taking a proactive stance to work out a solution demonstrates good faith as a borrower.

- Document everything: If you can work out an arrangement, be vigilant in documenting all communication and getting agreements in writing. Careful records may help clear up potential disputes down the road.

- Take advantage of student loan relief options: Federal student loans enter default after 270 days of missed payments. That’s a lot of time to explore deferment, forbearance, income-based payments, or other repayment options.

- Modify your mortgage: Rather than defaulting on your home loan, look for ways to lower your monthly payments through loan modification or refinancing. There are also several government programs designed to help homeowners in trouble.

- Meet with a credit counselor or financial professional: A licensed credit counselor can help you evaluate your financial position and set up a debt management plan.

In short, going into default on your loans should be avoided at all costs. However, there are multiple methods to stay in good standing with your lender, and help is available. With a bit of forward thinking, you can avoid loan default and its nasty consequences.