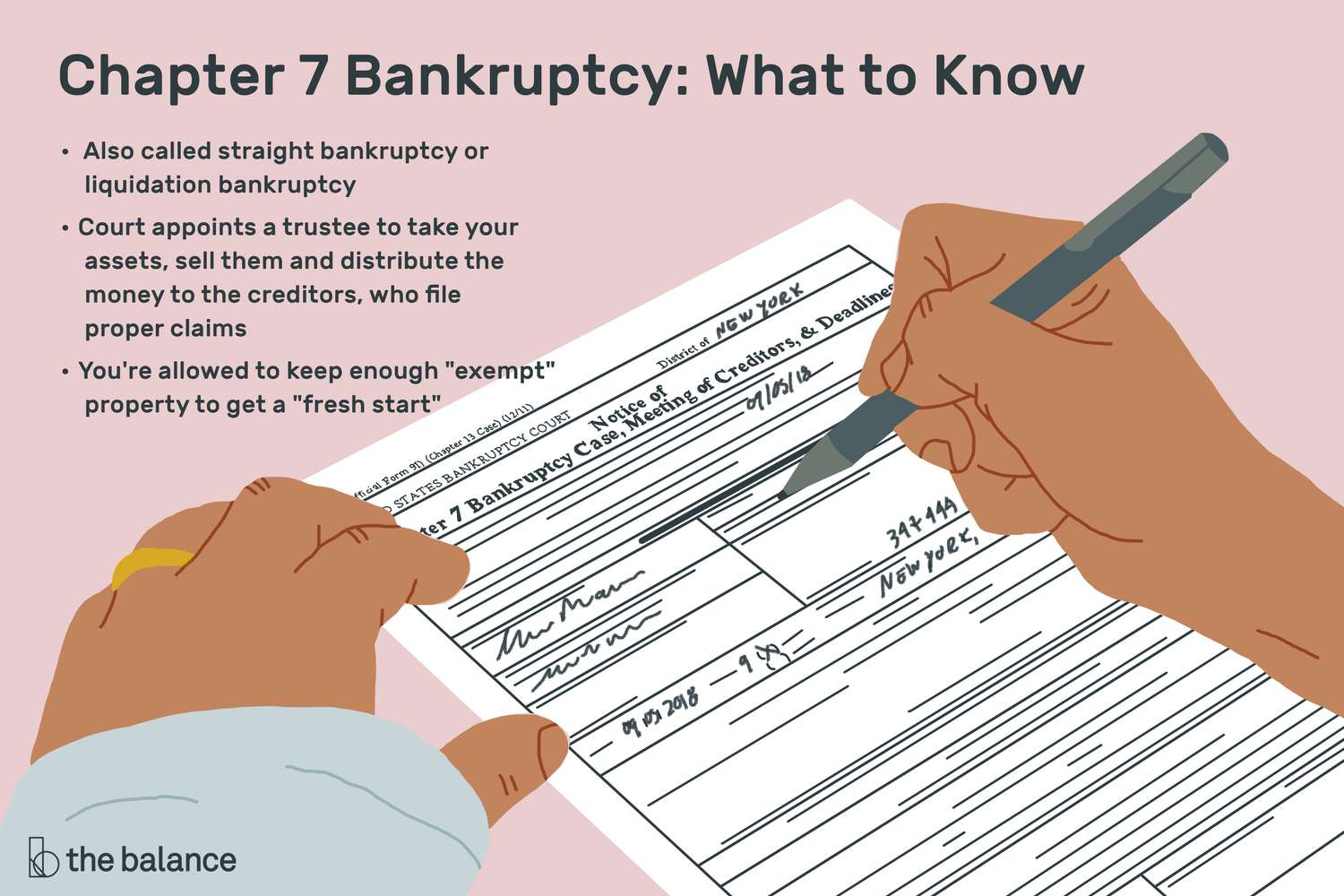

| Chapter 7 Bankruptcy | Chapter 11 Bankruptcy |

| Known as “liquidation” or “straight” bankruptcy | Known as “reorganization” or “rehabilitation” bankruptcy |

| More often used by individuals to help repay debts | More often used by businesses to help repay debts while continuing operations |

| The process generally takes four to six months. | Process can last years |

Requirements for Filing Chapter 7 Bankruptcy

Gather all of your financial records, such as bank statements, credit card statements, loan documents, and paystubs. You will need this information to complete the petition, schedules, statement of financial affairs, and other documents that you must submit to the court. You can download copies of these documents for free from the US Courts website.

Chapter 7 documents include a voluntary petition for relief, schedules of assets and liabilities, declarations regarding debtor education, and a statement of financial affairs. They include listings of all your property, debts, creditors, income, expenses, and property transfers.

You or your attorney will file everything with the clerk of your local bankruptcy court. You must pay a filing fee.

Tip

You can visit the federal court locator page, choose “Bankruptcy” under “Court Type,” and add your location in the bottom box to find your local court.

Credit Counseling

Almost every individual debtor who wants to file a Chapter 7 case must participate in a session with an approved credit counselor before the case can be filed. The session can be attended in person, online, or by telephone. The US Department of Justice provides an interactive search tool on its website to help you find approved credit counselors in your area.

The rationale behind this requirement is that some potential bankruptcy filers don’t know that they have other options. A credit counselor might be able to suggest alternatives that could keep you out of bankruptcy court.

Most debtors will also have to take a course in financial management before they can receive a discharge. This class is often given by the same entity you use for credit counseling. Plan to spend about two hours in person, online, or on the telephone in each class.

The Means Test

Debtors must also pass the “means test” calculation, another document that must be completed when you file. This test was added to the Bankruptcy Code in 2005. It calculates whether you’re able to afford (or have the “means”) to pay at least a portion of your debts.

The median test compares your household income with the median income for your state. It then compares your expenses to IRS local standards as to what people typically pay for similar expenses in your area.

You can only file a Chapter 7 bankruptcy under very specialized exceptions if you fail the means test. Your alternative would be to file a Chapter 13 repayment plan case instead. The means test calculation requires completing and submitting Official Form 122A-2 with the bankruptcy court.

The Meeting of Creditors

The court will issue notice of a debtor’s “meeting of creditors” when a Chapter 7 bankruptcy is filed. This is often referred to as the “341 meeting” after the bankruptcy code number that provides for it. The notice is sent to all of the creditors that are listed in your bankruptcy documents.

Any creditor can appear at the meeting and ask the debtor questions about their bankruptcy and their finances. The most common creditors that typically appear are auto lenders who want to know what you intend to do about your car payment if you have one.

Note

Bankruptcy court judges are not permitted to attend the meeting of creditors. This rule is intended to ensure that they remain impartial.

The bankruptcy trustee will ask the debtor various questions at this meeting as well, such as whether all information in the bankruptcy documents is true and correct. They will determine that the debtor understands all of the ramifications of filing for bankruptcy and receiving a discharge.

The trustee may continue the meeting of creditors on a future date if they want to investigate certain aspects of the bankruptcy further.

The Debtor’s Discharge

The bankruptcy court will automatically grant a discharge if the trustee and the creditors do not object on supportable grounds. The last day to file a complaint objecting to a debtor’s discharge is 60 days after the meeting of creditors, or after the date of the first meeting if it is continued and carried over to another date or dates. The discharge is usually entered several days later if no complaint is filed. It prevents creditors from attempting to collect any debt against you personally if you incurred it before the filing date of your bankruptcy petition.

Some debts are not dischargeable, including certain taxes and child support or spousal support obligations. They’ll survive the Chapter 7 proceedings, and you’ll still owe them.

A creditor can also still collect on a discharged debt from a co-debtor if someone signed on the loan or debt with you and they didn’t also file for bankruptcy.